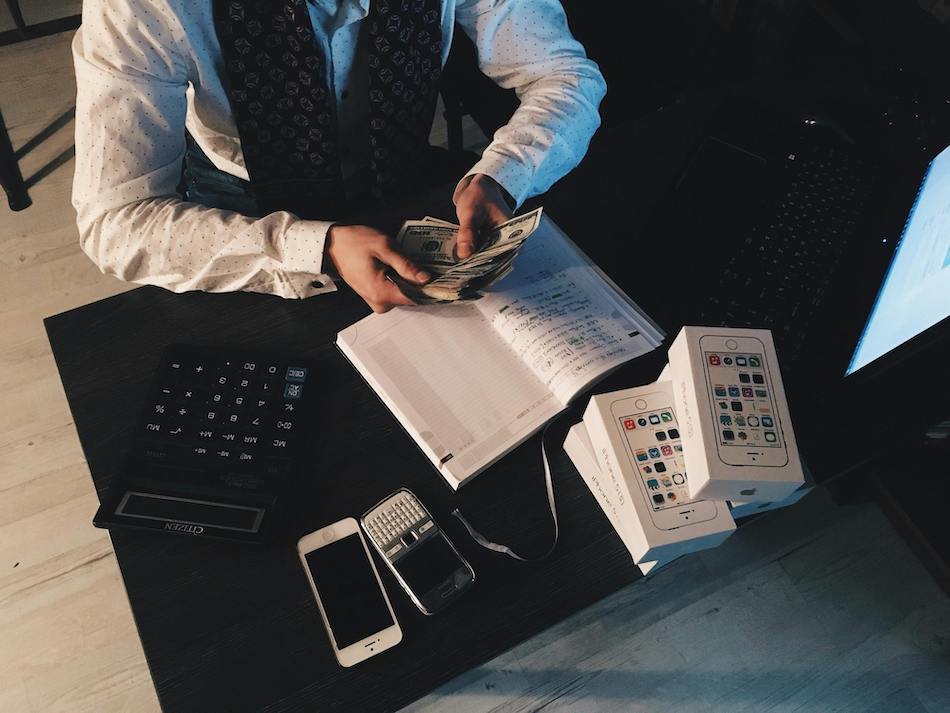

How to Track Business Expenses for Maximum Tax Savings

Tracking business expenses is crucial for every entrepreneur & 1099 workers. It helps properly manage cash flow, maximizing tax deductions as well as maintaining financial health. However, many beginners struggle with expense tracking, often leading to missed write-offs and inaccurate records. Here’s a guide to help you streamline the process and ensure you take full advantage of tax savings.

Why Expense Tracking Matters

Proper expense tracking helps businesses:

- Reduce taxable income by claiming all eligible deductions.

- Maintain accurate financial records for budgeting and growth.

- Avoid IRS audits and penalties by keeping organized records.

Common Expense Tracking Challenges

Many small business owners and freelancers struggle with the followings:

- Forgetting to log small, recurring expenses.

- Misplacing receipts and invoices.

- Mixing personal and business expenses.

- Not categorizing expenses correctly.

Step-by-Step Guide to Tracking Business Expenses

1. Separate Business and Personal Finances

One of the biggest mistakes beginners make is using the same bank account for business and personal expenses. Open a dedicated business checking account and credit card to keep transactions separate and simplify tracking.

2. Use Expense Tracking Software

Manual expense tracking is time-consuming and prone to errors. A bookkeeping tool or app automates the process, allowing you to:

- Scan and store receipts digitally.

- Categorize transactions automatically.

- Generate expense reports for tax filing.

3. Keep Digital Copies of Receipts

The IRS requires proof of business expenses, so keeping receipts is essential. Instead of storing paper copies, use digital tools to scan and save receipts in an organized manner.

4. Categorize Expenses Correctly

Misclassifying expenses can lead to inaccurate tax deductions. Common categories include:

- Office supplies

- Travel and transportation

- Marketing and advertising

- Home office expenses

- Professional services (lawyers, accountants, etc.)

5. Track Expenses in Real-Time

Rather than waiting until tax season, log expenses as they occur. Setting aside a few minutes each week to review and record expenses ensures accuracy and reduces last-minute stress.

6. Understand Tax-Deductible Expenses

Some commonly overlooked tax-deductible expenses include:

- Business meals (50% deductible)

- Mileage for business travel

- Internet and phone expenses (if used for business)

- Education and training related to your field

7. Reconcile Expenses with Bank Statements

Regularly compare your recorded expenses with bank and credit card statements to catch discrepancies and avoid potential errors.

Maximizing Tax Savings with Proper Expense Tracking

Accurate expense tracking doesn’t just save you time; it ensures you don’t miss out on valuable tax deductions. By implementing a structured system and leveraging technology, you can streamline your finances and keep more money in your pocket.

Start tracking your expenses today to optimize your tax savings and grow your business with confidence! Use Tabby!

Leave a Reply