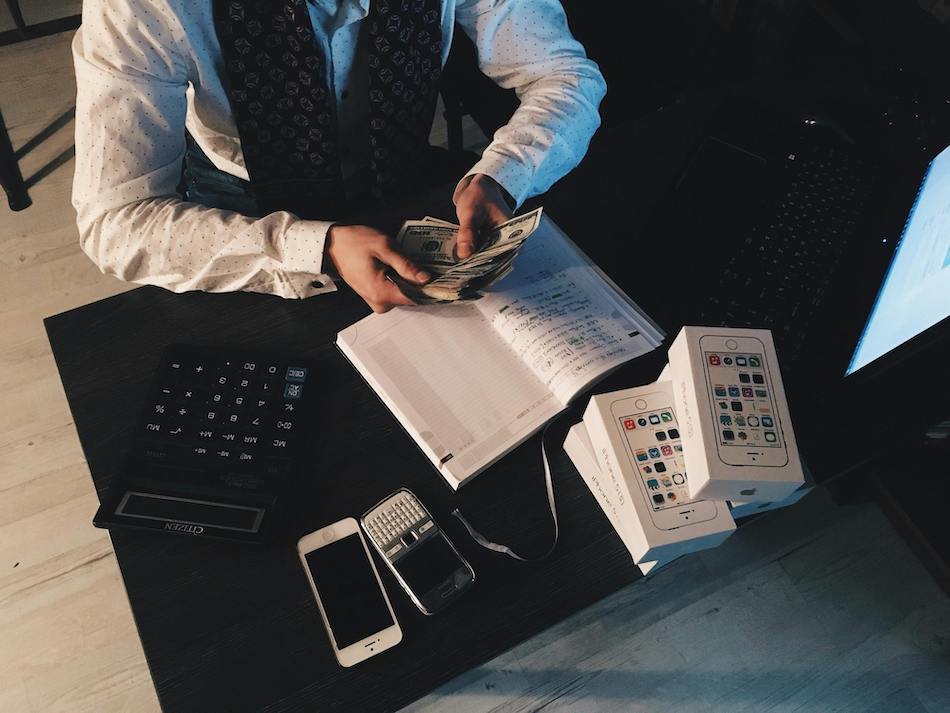

How to Separate Business & Personal Expenses to Avoid IRS Issues

Properly separating business and personal expenses is essential for tax compliance and financial clarity. This is essential for avoiding IRS scrutiny. Many small business owners and freelancers make the mistake of mixing their finances, which lead to missed deductions, tax penalties and even audits. In this guide, we’ll explain why keeping these expenses separate is crucial. We will also show how to do it effectively and how AI-powered tools like Tabby can streamline the process.

Why Separating Business & Personal Expenses Matters

Failing to distinguish between business and personal expenses can cause major financial and legal issues. Here’s why maintaining separation is critical:

- IRS Compliance & Audit Protection: The IRS requires clear records for deductible business expenses. Mixed expenses can trigger audits and lead to penalties.

- Accurate Tax Deductions: Keeping expenses separate ensures you claim all legitimate business deductions, maximizing your tax savings.

- Financial Clarity: Organized finances help you track profitability, manage cash flow, and make informed decisions.

- Easier Bookkeeping: Categorizing transactions correctly from the start simplifies tax filing and financial reporting.

How to Separate Business & Personal Expenses

1. Open a Dedicated Business Bank Account

The first step in maintaining financial separation is having a separate checking account for your business. This helps you to:

- Deposit all business income into one account.

- Pay for business expenses directly from the business account.

- Easily track business transactions without sorting through personal expenses.

2. Get a Business Credit Card

A business credit card helps establish a clear boundary between personal and business spending. Using it exclusively for business purchases ensures easy expense tracking and can help build business credit.

3. Use AI-Powered Bookkeeping for Expense Categorization

Manually tracking and categorizing expenses can be time-consuming and error-prone. AI-powered bookkeeping tools like Tabby automate this process by:

- Automatically identifying and categorizing business transactions.

- Syncing with your bank accounts to ensure accurate financial records.

- Generating tax-ready reports, reducing the risk of IRS issues.

4. Establish Clear Expense Policies

For those who occasionally use personal funds for business expenses, establish clear guidelines:

- Always keep receipts and records.

- Reimburse yourself through the business account.

- Avoid excessive personal spending on business accounts.

5. Keep Detailed Records and Receipts

The IRS recommends keeping business expense records for at least three years. Digital receipt tracking tools can help store and organize receipts for easy retrieval during tax season.

6. Pay Yourself a Salary (For LLCs and Corporations)

If your business is structured as an LLC or corporation, paying yourself a fixed salary instead of withdrawing money randomly helps maintain clear financial boundaries.

7. Consult a Tax Professional

If you’re unsure about specific expenses or need help setting up a financial system, consult a tax professional to ensure compliance with IRS regulations.

Separating business and personal expenses is a fundamental practice that protects your business from IRS scrutiny, ensures accurate tax deductions and simplifies bookkeeping. With AI-powered solutions like Tabby, you can automate expense tracking and focus on growing your business without the hassle of financial mismanagement.

Want to streamline your expense tracking and stay IRS-compliant? Try an AI-powered bookkeeping tool today!

Want to simplify your expense tracking? Try Tabby today!

Leave a Reply