AI vs. Manual Bookkeeping: Which One Saves More Time & Money?

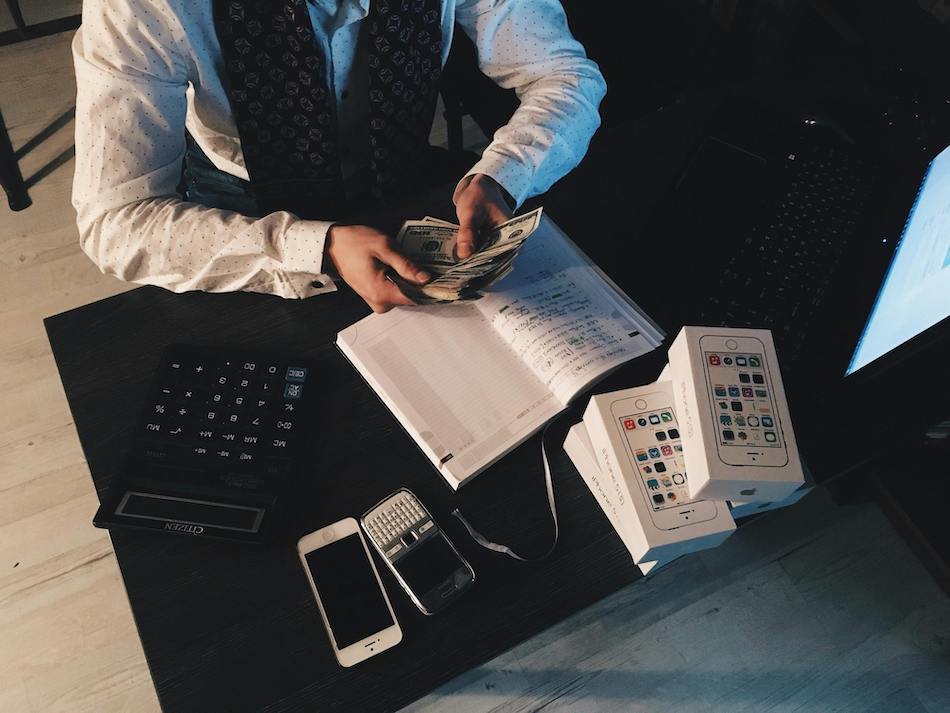

Bookkeeping is an essential task for any business, but it can be time-consuming and costly—especially for small business owners, freelancers and self-employed professionals. With the rise of AI-powered bookkeeping, many are now questioning whether manual bookkeeping is still the best option.

So, which one saves more time and money? Let’s compare AI vs. manual bookkeeping and see which is the smarter choice for business owners in 2025.

1. Time Efficiency: AI vs. Manual Bookkeeping

Manual Bookkeeping:

- Requires tracking every expense, categorizing transactions and balancing books manually.

- Time-consuming, especially for business owners without accounting experience.

- Risk of human errors, leading to financial discrepancies.

- Requires dedicated hours each week for record-keeping and reconciliation.

Average Time Spent: 5-10 hours per month for small business owners.

AI-Powered Bookkeeping:

- Automatically syncs with bank accounts and credit cards, tracking transactions in real-time.

- Uses machine learning to auto-categorize expenses without manual input.

- Reduces errors by eliminating manual data entry.

- Generates financial reports instantly, saving hours of administrative work.

Average Time Spent: Less than 1 hour per month with AI automation.

Winner: AI-powered bookkeeping—it dramatically cuts down time spent on financial management.

2. Cost Comparison: AI vs. Manual Bookkeeping

Manual Bookkeeping:

- Hiring a bookkeeper can cost anywhere from $200 to $500 per month (or more for complex businesses).

- DIY bookkeeping still requires accounting software subscriptions like QuickBooks or Xero ($30–$70/month).

- Errors in manual bookkeeping can lead to IRS penalties and compliance issues, costing thousands.

Estimated Annual Cost: $2,400–$6,000+ for small businesses.

AI-Powered Bookkeeping:

- Affordable AI bookkeeping tools like Tabby start at a fraction of traditional bookkeeping costs.

- No need to hire an accountant for basic bookkeeping—AI automates the process.

- Saves money by identifying tax deductions business owners might otherwise miss.

Estimated Annual Cost: $120–$600 (depending on the AI software).

Winner: AI-powered bookkeeping—it’s more cost-effective and reduces financial risks.

3. Accuracy & Compliance

Manual Bookkeeping:

- Prone to human errors, miscalculations, and data entry mistakes.

- Requires constant reconciliation and checking for accuracy.

- Staying compliant with tax laws and regulations is challenging without expertise.

AI-Powered Bookkeeping:

- Uses algorithms to ensure 100% accuracy in expense tracking.

- AI tools keep up with tax laws and regulations, reducing compliance risks.

- Automated reports help business owners stay prepared for tax season.

Winner: AI-powered bookkeeping—it eliminates human errors and ensures compliance.

4. Tax Preparation & Deductions

Manual Bookkeeping:

- Requires manually tracking deductible expenses throughout the year.

- Risk of missing deductions, leading to higher tax bills.

- Tax season can be stressful, requiring extra work to organize financial records.

AI-Powered Bookkeeping:

- Automatically tracks deductions like home office expenses, mileage, and business meals.

- Generates tax-ready reports, making tax filing seamless.

- Ensures no deduction is overlooked, saving money during tax season.

Winner: AI-powered bookkeeping—it maximizes deductions effortlessly.

5. Scalability & Business Growth

Manual Bookkeeping:

- As businesses grow, managing finances becomes more complex.

- Scaling requires hiring more bookkeepers or accountants, increasing costs.

AI-Powered Bookkeeping:

- AI scales with your business—whether you’re a freelancer or running a growing startup.

- No need to hire extra staff—AI can handle increasing transactions effortlessly.

Winner: AI-powered bookkeeping—it supports business growth without added costs.

AI vs. Manual Bookkeeping

| Feature | Manual Bookkeeping | AI-Powered Bookkeeping |

| Time Spent | 5-10 hours/month | Less than 1 hour/month |

| Cost | $2,400–$6,000+/yr | $120–$600/yr |

| Accuracy | Prone to errors | 100% automated & accurate |

| Tax Savings | Risk of missing deductions | Tracks all deductions automatically |

| Scalability | Hard to scale | Scales with business growth |

AI-powered bookkeeping is the clear winner!

Ready to Save Time & Money with AI?

Ditch the spreadsheets and manual work. Tabby automates your bookkeeping, maximizes tax savings, and keeps your finances in check—all at a fraction of the cost.

Try Tabby today and focus on growing your business while AI handles your books!

Leave a Reply