Commonly Missed Business Write-Offs That Could Save You Thousands

Maximizing tax deductions is essential for every small business owner or self-employed professional for reducing taxable income and keeping more money in pocket. However, many business owners often overlook valuable write-offs. As a result, they lose the chance of saving thousands of dollars each year. Here are some commonly missed business expenses that you should take advantage of.

1. Home Office Deduction

If you work from home, you may be eligible for a home office deduction. Your workspace must be used exclusively and regularly for business purposes to be qualified for it. You can calculate it in two ways:

- Simplified Method: Deduct $5 per square foot of your home office (up to 300 square feet).

- Actual Expense Method: Deduct a percentage of your rent/mortgage, utilities, insurance and other expenses based on the proportion of your home used for business.

2. Business-Related Subscriptions and Memberships

Many professionals forget to write off industry-related subscriptions. Are you one of them? Make sure to include these:

- Trade journals and magazines

- Online courses and webinars

- Professional organization membership fees

These expenses are fully deductible as long as they are directly related to your business.

3. Retirement Contributions

Contributing to a retirement plan secures your future. But did you know that it also provides tax advantages? Yes, retirement plans do provide tax advantages. Self-employed individuals can contribute to the followings:

- SEP-IRA (Simplified Employee Pension)

- Solo 401(k)

- SIMPLE IRA

These contributions are tax-deductible. Make sure to use these to lower your taxable income and build long-term savings.

4. Health Insurance Premiums

If you are self-employed and not eligible for an employer-sponsored health plan, you get to deduct health, dental and long-term care insurance premiums, for yourself as well as your spouse and dependents.

5. Vehicle Expenses

Many business owners use their personal vehicles for business purposes but fail to deduct the associated costs. You can claim mileage or actual expenses, such as:

- Gasoline

- Maintenance and repairs

- Insurance

- Depreciation The IRS standard mileage rate for 2024 is 67 cents per mile, or you can deduct the actual expenses incurred for business-related travel.

6. Business Meals and Entertainment

While personal meals are not deductible, business meals with clients, partners or employees can be. You can deduct 50% of meal expenses as long as they are directly related to business discussions.

7. Software and Technology Expenses

Subscription-based tools and software necessary for running your business are tax-deductible, including:

- Accounting software

- Project management tools

- Customer relationship management (CRM) systems

- Cloud storage services

8. Marketing and Advertising Costs

All expenses related to promoting your business are deductible, such as:

- Website hosting and domain fees

- Social media advertising

- Business cards and promotional materials

- Paid online ads (Google, Facebook, LinkedIn, etc.)

9. Education and Training

Improving your skills through education directly related to your industry is a deductible expense. This includes:

- Online courses

- Workshops and seminars

- Books and training materials

10. Startup Costs

If you’re launching a new business, you can deduct up to $5,000 in startup expenses, such as:

- Legal and accounting fees

- Market research

- Business registration costs

11. Bad Debt

If a client refuses to pay an invoice or a loan you made for business purposes goes unpaid, you may be able to deduct it as a business loss.

12. Bank and Payment Processing Fees

Many business owners overlook the fees associated with:

- Credit card processing (Stripe, PayPal, Square, etc.)

- Business bank account fees

- Wire transfer costs These fees are fully deductible and can add up significantly over time.

13. Utilities and Internet

If you rent an office space, your electricity, water, and internet expenses are fully deductible. If you work from home, a percentage of these expenses can also be deducted based on business use.

14. Legal and Professional Fees

Expenses incurred for hiring accountants, tax professionals, or attorneys for business-related matters are fully deductible.

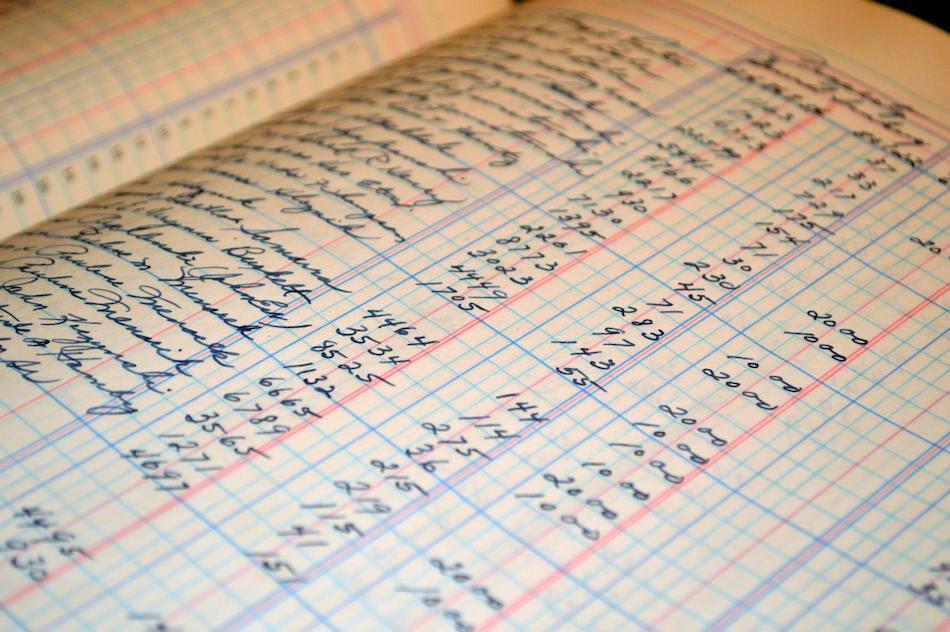

Taking advantage of these commonly missed business write-offs can help you significantly lower your taxable income and save money. Keeping accurate records and consulting with a tax professional can ensure you claim all the deductions you’re entitled to. Don’t leave money on the table—make sure to maximize your deductions this tax season!

Want to simplify tax processing? Use Tabby!

Leave a Reply