How Freelancers Can Simplify Bookkeeping & Never Miss a Tax Deduction

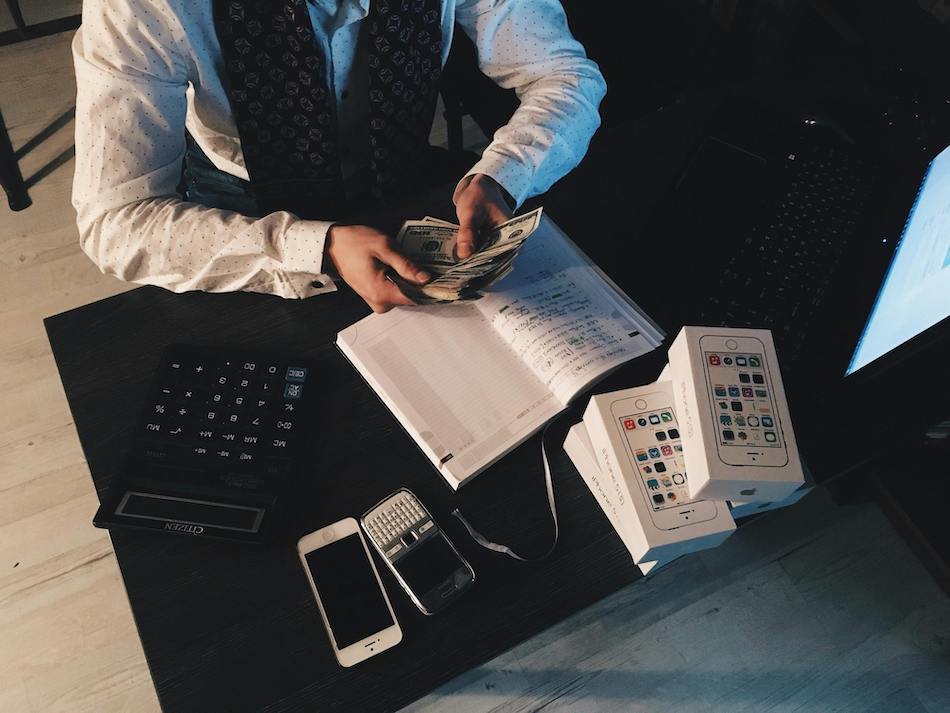

Freelancers often juggle multiple projects, clients and invoices, leaving little time to focus on bookkeeping. However, staying on top of your finances is crucial. It helps to maintain financial stability, also to maximize tax deductions. Missing even small deductions can cost you hundreds or even thousands of dollars annually. Fortunately, there are ways to simplify bookkeeping while ensuring you never miss a tax write-off.

1. Separate Business and Personal Finances

One of the biggest mistakes freelancers make is mixing business and personal expenses. Open a dedicated business bank account and use a separate credit card for business transactions. This makes it easier to track expenses, simplifies tax filing, and helps avoid IRS scrutiny.

2. Use Accounting Software

Manual bookkeeping can be time-consuming and prone to errors. Instead, use AI-powered accounting software to automatically categorize expenses, generate financial reports and track income. This reduces the risk of missing deductions and ensures accurate records.

3. Track All Business Expenses

Freelancers qualify for a range of tax deductions, but only if expenses are properly documented. Common deductible expenses include:

- Home office costs (if you work from home)

- Internet and phone bills (business portion only)

- Software subscriptions (design, accounting, or project management tools)

- Business travel and meals

- Marketing and advertising expenses

- Professional development (courses, books, certifications)

4. Automate Expense Tracking

Instead of manually saving receipts and logging expenses, use apps that automatically sync with your bank accounts and categorize transactions. Many bookkeeping tools even offer receipt-scanning features, ensuring that all deductible expenses are captured in real-time.

5. Set Aside Money for Taxes

As a freelancer, taxes aren’t automatically withheld from your income, so it’s essential to set aside a portion of earnings for quarterly estimated tax payments. A good rule of thumb is to save 25-30% of your income for taxes to avoid a financial surprise during tax season.

6. Hire a Tax Professional or Use AI-Powered Tax Software

Even with good bookkeeping habits, a tax professional can help maximize deductions and ensure compliance with tax laws. Alternatively, AI-powered tax software can analyze your financial data and suggest deductions you may have overlooked.

7. Review Your Finances Regularly

Dedicate time each month to review your income, expenses, and outstanding invoices. This habit helps prevent financial surprises, ensures you’re setting enough money aside for taxes, and allows you to adjust your budget as needed.

Bookkeeping doesn’t have to be overwhelming for freelancers. By using AI-powered tools, automating expense tracking, and staying organized, you can simplify your finances and ensure you never miss a tax deduction. Taking these steps will not only save time but also help you maximize your earnings and stay compliant with tax regulations.

Use Tabby!

Leave a Reply