How to Track Mileage & Business Travel Expenses Like a Pro

Tracking mileage and business travel expenses is essential for freelancers, small business owners and self-employed professionals. Accurate record-keeping ensures you maximize tax deductions and stay compliant with IRS regulations. Here’s a step-by-step guide to tracking your mileage and travel expenses like a pro.

Why Tracking Mileage & Travel Expenses Matters

- Maximize Tax Deductions – Business-related travel expenses, including mileage, can significantly reduce your taxable income.

- Stay IRS-Compliant – Proper records prevent issues in case of an audit.

- Understand Business Costs – Knowing how much you spend on travel helps you budget more effectively.

What Counts as a Business Travel Expense?

To be deductible, travel expenses must be ordinary and necessary for your business. This includes:

- Mileage for client meetings, job sites, and business errands.

- Flights & Lodging for work-related trips.

- Meals (50% deductible) during business travel.

- Rental Cars, Parking Fees & Tolls when traveling for business purposes.

The Best Ways to Track Mileage

1. Use a Mileage Tracking App

Mileage tracking apps automatically log trips using GPS. Some of the best apps include:

- Stride – Free and easy to use.

- MileIQ – Auto-tracks mileage and categorizes trips.

- Everlance – Includes automatic tracking and expense management.

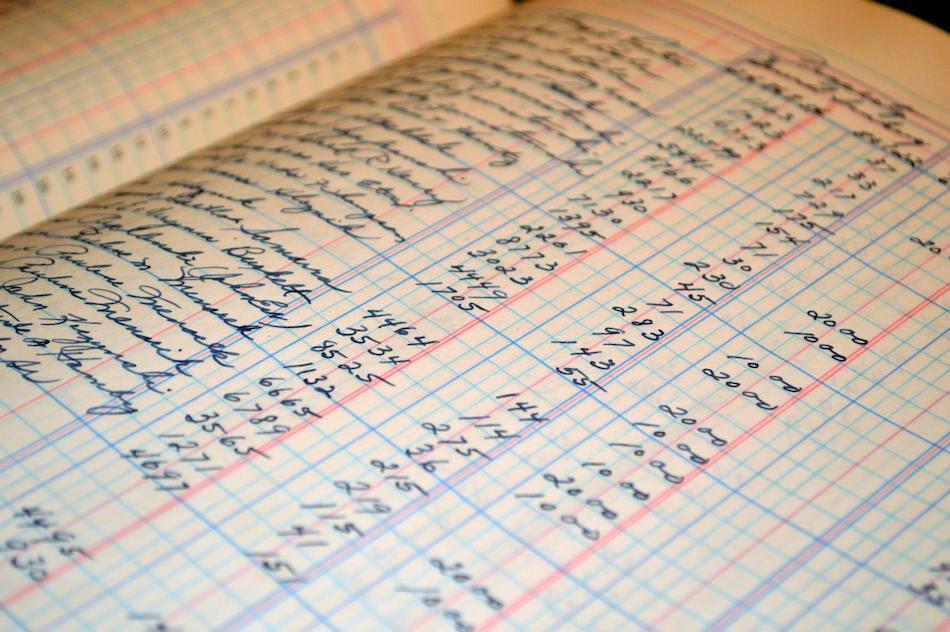

2. Keep a Manual Logbook

If you prefer a traditional approach, maintain a mileage log with:

- Date of trip

- Starting and ending locations

- Purpose of trip

- Miles driven

3. Leverage Your Vehicle’s Odometer

Record your odometer reading at the start and end of the year for backup documentation.

How to Track Other Business Travel Expenses

1. Save All Receipts

Keep receipts for flights, hotels, meals, and transportation. Digital storage tools like Google Drive or Expensify help keep things organized.

2. Use a Business Credit Card

A dedicated business card simplifies expense tracking and keeps personal and business spending separate.

3. Categorize Expenses in a Bookkeeping Tool

AI-powered bookkeeping tools like Tabby automatically categorize expenses, making tax filing easier.

Standard Mileage Rate vs. Actual Expense Method

You can deduct vehicle expenses using one of two methods:

1. Standard Mileage Rate (2024: 67 cents per mile)

- Simplest method—multiply business miles driven by the IRS mileage rate.

- Ideal for freelancers and small business owners with minimal car-related expenses.

2. Actual Expense Method

- Deducts actual car expenses, including gas, maintenance, insurance, and depreciation.

- Best for those with high vehicle costs related to business use.

Pro Tips for Hassle-Free Mileage & Travel Expense Tracking

- Log Mileage & Expenses Weekly – Don’t wait until tax season to organize your records.

- Set Up Expense Categories – Use bookkeeping software to separate travel, lodging, and meals.

- Keep Backup Documentation – Store receipts digitally in case of IRS audits.

Tracking mileage and business travel expenses doesn’t have to be overwhelming. By using mileage tracking apps, maintaining detailed records, and leveraging AI-powered bookkeeping tools like Tabby, you can ensure accuracy, maximize deductions, and stay compliant with tax regulations. Start organizing your travel expenses today to save time and money at tax season!

Leave a Reply