Why Self-Employed Professionals Should Automate Their Bookkeeping

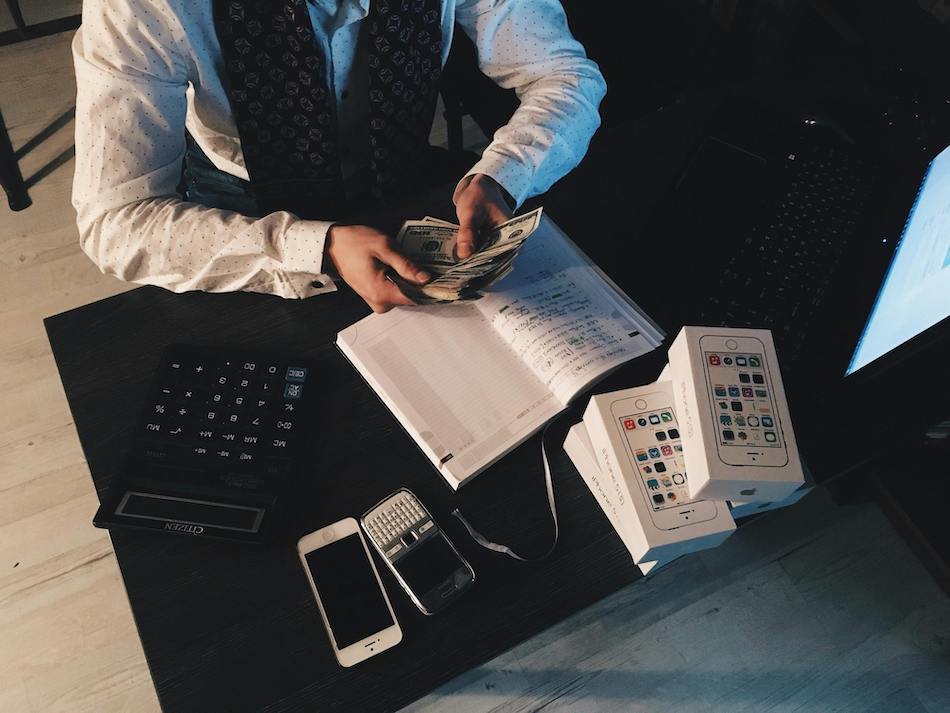

As a self-employed professional, you wear multiple hats—handling clients, managing projects and growing your business. But bookkeeping? That’s one task most freelancers and small business owners dread.

Yet, accurate bookkeeping is essential to track income, manage expenses and maximize tax deductions. The good news? Automation can make bookkeeping effortless—saving you time, stress and money.

Let’s explore why self-employed professionals should automate their bookkeeping and how AI-powered tools like Tabby can help.

1. Save Hours Every Month with AI-Powered Bookkeeping

Manual bookkeeping takes hours—sorting receipts, categorizing expenses, and preparing tax records. This time could be better spent growing your business.

How Automation Helps:

- Syncs with your bank accounts & credit cards to track transactions in real-time.

- Uses AI to categorize expenses automatically (e.g., travel, marketing, office supplies).

- Eliminates manual data entry, saving you 5–10 hours per month.

Example: Instead of spending weekends updating spreadsheets, an AI bookkeeping tool like Tabby keeps your records updated automatically.

2. Never Miss a Deduction & Maximize Tax Savings

Self-employed professionals often overpay on taxes simply because they miss deductions. Manually tracking business expenses makes it easy to forget what qualifies as a tax write-off.

How Automation Helps:

- Flags tax-deductible expenses in real-time, so you never miss a write-off.

- Tracks mileage, home office expenses and business-related purchases automatically.

- Generates tax-ready reports, making it easy to file taxes or send records to an accountant.

Common Deductions Self-Employed Professionals Miss:

Home office expenses (rent, internet, utilities)

Business meals (50% deductible when meeting clients)

Travel & transportation costs (flights, Uber, fuel)

Software subscriptions (Adobe, Canva, bookkeeping tools)

Professional development (courses, certifications)

Example: If you buy a new laptop for work but forget to log it, AI bookkeeping tools will recognize it as a business expense and categorize it as a deduction.

3. Reduce Stress During Tax Season

For self-employed professionals, tax season can be a nightmare—digging through bank statements, receipts, and spreadsheets.

How Automation Helps:

- Keeps records organized year-round, eliminating last-minute scrambling.

- Generates profit & loss statements and tax reports with a click.

- Integrates with tax filing software, making reporting seamless.

Example: Instead of manually calculating income and expenses, automated bookkeeping tools generate a tax-ready summary—ready to file in minutes.

4. Get Accurate Financial Insights in Real-Time

Many self-employed professionals struggle with cash flow management. Without proper tracking, it’s hard to know how much money is coming in and going out.

How Automation Helps:

- Provides real-time financial insights (income, expenses, profit).

- Alerts you to unusual spending patterns or cash flow gaps.

- Helps plan for quarterly tax payments to avoid surprises.

Example: Instead of guessing your income, an AI tool like Tabby provides a dashboard with up-to-date financial reports.

5. Avoid Costly Bookkeeping Mistakes

Manual bookkeeping often leads to errors—incorrect expense categorization, missing transactions, or miscalculating profit.

How Automation Helps:

- AI-powered bookkeeping ensures 100% accuracy in financial records.

- Reconciles bank transactions automatically, reducing human errors.

- Provides audit-proof record-keeping, reducing IRS audit risks.

Example: If you accidentally categorize a personal expense as a business deduction, AI bookkeeping tools will flag it for review.

6. Scale Your Business Without Hiring an Accountant

Many freelancers and solopreneurs hesitate to hire an accountant due to the cost. Automated bookkeeping provides an affordable alternative.

Cost Comparison:

| Feature | AI Bookkeeping Software | Hiring an Accountant |

| Cost | $10–$50/month | $1,000+ per year |

| Time Spent | < 1 hour/month | Multiple hours/month |

| Accuracy | AI minimizes errors | Depends on manual work |

| Tax Reporting | Auto-generates reports | Requires accountant review |

Winner: AI-powered bookkeeping—it’s cheaper, faster, and just as reliable for self-employed professionals.

If you’re self-employed, automating bookkeeping is a no-brainer. It saves time, reduces errors, maximizes tax deductions, and eliminates the stress of managing finances.

Stop wasting time on spreadsheets! Tabby automates bookkeeping, tracks expenses, and prepares tax reports—so you can focus on growing your business.

Try Tabby today and simplify your bookkeeping!

Leave a Reply